Calculate federal withholding per paycheck 2023

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Start the TAXstimator Then select your IRS Tax Return Filing Status.

2023 Military Pay Chart 4 6 All Pay Grades

Based on your projected tax withholding for the year we can also estimate your tax refund or.

. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. In the past the value of withholding allowances was also tied to. Withhold half of the total 765 62 for.

Free Federal and State Paycheck Withholding Calculator. For employees withholding is the amount of federal income tax withheld from your paycheck. Begin tax planning using the 2023 Return Calculator below.

401 k403 b plan withholding This is the percent of your. Please enter a dollar amount from 1 to 1000000. There are two main methods small businesses can use to calculate federal withholding tax.

Ad Compare and Find the Best Paycheck Software in the Industry. Ad Payroll So Easy You Can Set It Up Run It Yourself. Instead the form uses a 5-step process and new Federal Income Tax Withholding Methods to determine actual withholdings.

Multiply taxable gross wages by the number of pay periods per year. Get Started Today with 2 Months Free. Taxpayers whose employers withhold federal income tax from their paycheck can use the IRS Tax Withholding Estimator to help decide if they should make a change to their.

250 and subtract the refund adjust amount from that. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Assistance with Determining Your Federal Withholding To change the amount of the.

Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. All Services Backed by Tax Guarantee.

2022 2023 Tax Brackets Rates For Each Income Level Calculate your state. Sign up for a free Taxpert account and e-file your returns each year they are due. Then look at your last paychecks tax withholding amount eg.

Simplify Your Day-to-Day With The Best Payroll Services. The IRS hosts a withholding calculator online tool. Our 2022 GS Pay.

Welcome to the FederalPay GS Pay Calculator. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

Use this tool to. We refer to the amount of wages taken from your paycheck. Enter your filing status income deductions and credits and we will estimate your total taxes.

Get Your Quote Today with SurePayroll. Get a head start on your next return. The result is net income.

How to calculate annual income. The maximum an employee will pay in 2022 is 911400. How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4.

The General Schedule GS payscale is used to calculate the salaries for over 70 of all Federal government employees. Lets call this the refund based adjust amount. Instead you fill out Steps 2 3 and.

The wage bracket method and the percentage method. Gross pay This is your gross pay before any deductions for the pay period.

2022 Federal Payroll Tax Rates Abacus Payroll

1 15 5 G1 Gross Income Vs Net Incomeevan Earns 1600 00 Personal Financial Literacy Financial Literacy Income

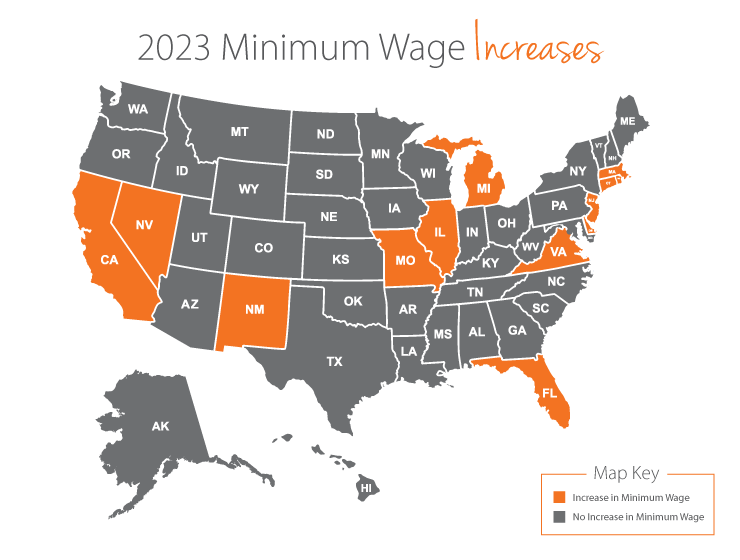

Minimum Wage By State 2022 And 2023 Changes

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

2023 Va Disability Pay Dates The Insider S Guide Va Claims Insider

Pay Scale Revised In Budget 2022 23 Chart Grade 1 To 21 Bise World Pakistani Education Entertainment Salary Increase Salary Math Tutorials

Independent Contractor Pay Stub Template Payroll Template Fake Money Printable Payroll Checks

Collin County College Calendar Collin County Calendar Board College

Federal Government Pay Period Calendar 2020 Period Calendar Payroll Calendar Calendar Printables

Social Security What Is The Wage Base For 2023 Gobankingrates

How To Pay Payroll Taxes A Step By Step Guide

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Early Social Security Ssi Cola Predictions For 2023 Youtube

2023 Military Pay Chart 4 6 All Pay Grades

Paycheck Tax Withholding Calculator For W 4 Tax Planning

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2